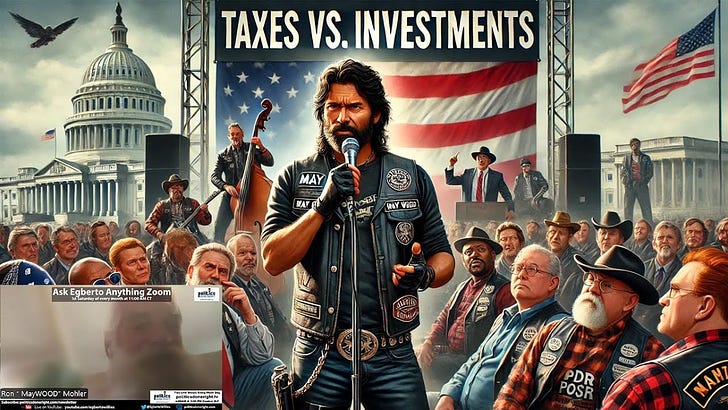

May Wood, a biker & PDR Posse member, exposes conservative thinking on taxes vs. investments.

PDR member and biker May Wood had some important words for our conservative thinkers. They must reevaluate when taxes are not taxes but investments that pay dividends several times over.

YOU CAN MAKE THE DIFFERENCE: This Project needs 25 new paid members today. Would you be willing to be one?

We are grateful for our Paid Subscribers and Free Subscribers. In this political climate, we need several hundred more Paid Subscribers. Misinformation funded by the deep pockets of our Oligarchy floods the internet. We are using all our platforms on-air, online, and in publications to counter that. We ask that you invest the equivalent of less than a coffee to ensure we can keep doing this effectively. Please invest in a Democracy that serves all of us by becoming a paid subscriber. It comes with many benefits.

A biker exposes conservative thinking on taxes

In the conversation around taxes, investments, and government spending, conservatives have long pushed a narrative that lower taxes and reduced government expenditure are essential for economic growth. However, progressive thinkers argue that taxes are more than just a financial burden—they’re an investment in society. May Wood, a frequent participant in the monthly Ask Egberto Anything Zoom meeting, provided a powerful rebuttal to conservative ideology, pointing out the difference between reckless expenses and genuine investments that benefit the broader population. His argument helps to underscore a key progressive principle: government spending, when done responsibly, is not just an outlay of resources but a way to build a better, more equitable society.

May Wood begins by drawing a distinction that is too often overlooked by fiscal conservatives. He states, “There is a big difference between making an investment and making an expense.” This is a key point because conservative rhetoric often conflates the two. For decades, Republican and right-wing leaders have pushed for lower taxes and reduced spending under the guise of fiscal responsibility. However, as May Wood eloquently explains, not all spending is the same. The money spent on education, healthcare, and infrastructure fundamentally differs from spending on military expansion, which often doesn’t provide a return on investment.

Wood touches on a critical issue: the bloated U.S. military budget. He notes that the United States spends “six times more than the next six governments combined” on its military. Yet, this spending does not generate economic returns for the average American. While military investments do create jobs and contribute to national security, excessive military expenditure does not fuel economic mobility or solve systemic social inequalities. Instead, this type of spending falls into the category of an expense—money that is gone without ever coming back to benefit the everyday taxpayer.

In contrast, Wood argues that education, healthcare, and infrastructure investments have tangible returns for society. By building schools, roads, and hospitals, the government is not just “spending” money but investing in human capital and physical infrastructure to generate long-term benefits. Wood reminds the audience that the United States once led the world in innovation and education precisely because it prioritized public investments. For example, the race to the moon was fueled by federal investments in higher education, which sent thousands of Americans to college for free or at minimal cost. This investment resulted in a generation of highly educated professionals who helped push the boundaries of science, technology, and innovation.

However, as Wood points out, this investment culture began to change with the rise of conservative anti-tax movements led by figures like Ronald Reagan. These movements attacked government spending as wasteful and pushed for tax cuts for the wealthy, arguing that this would lead to greater economic growth through the so-called trickle-down effect. In reality, this shift in policy has had devastating effects. Today, the United States lags behind much of the world in education and healthcare. As Wood succinctly puts it, “Everybody else in the world has universal healthcare and free education, and they’re beginning to take us over.” Countries that were once inspired by American innovation are now surpassing the United States by making the very investments that conservative politicians in America have decried for decades.

Perhaps most strikingly, Wood highlights the historical irony of conservative opposition to policies like universal healthcare. He notes that universal healthcare was once a Republican idea. In the late 1960s, moderate Republicans supported ideas like universal healthcare and free education. Even President Richard Nixon, a conservative icon, proposed a healthcare plan that would have guaranteed coverage for all Americans. However, over time, the Republican Party shifted further to the right, and policies that once aimed to benefit the majority of Americans were abandoned in favor of tax cuts for corporations and the wealthy.

May Wood’s analysis exposes the faulty logic of conservative fiscal policy. He makes it clear that investing in public goods like education and healthcare is not just good policy but an essential part of building a stronger and more competitive country. The conservative obsession with reducing taxes and cutting spending may benefit the wealthy in the short term, but it ultimately weakens the entire nation. As Wood emphasizes, “We’re just throwing up a ladder to the wealthy in the forms of tax cuts and policies that support them and not us.”

May Wood’s commentary on Politics Done Right is a wake-up call to those who have bought into the conservative narrative that all government spending is wasteful. By drawing a clear distinction between expenses and investments, he shows that progressive policies focused on education, healthcare, and infrastructure are fiscally responsible and necessary for the country’s long-term success. If more Americans adopt this perspective, they may see through the misleading calls for lower taxes and start demanding policies prioritizing investments in the common good. Only then can the United States reclaim its position as a global leader in innovation and equality.

Viewers are encouraged to subscribe and join the conversation for more insightful commentary and to support progressive messages. Together, we can populate the internet with progressive messages that represent the true aspirations of most Americans.

Can we count on your help to reach our goal of 300 needed new paid subscriptions by the end of the month?

The other side has big donors and everyday citizens who invest heavily in platforms that lie and misinform. All we have is you. So, please invest in our media outlet by clicking the subscribe button below to become a paid subscriber. You won’t miss that coffee, but it will make a difference in our politics as we spread the truth about our policies and progressive politics. All paid subscribers get to read my five books on this platform and all subsequent books I write. They will also be privy to subsequent incentives.

Since we're talkin' expense vs investment (and return on that investment): a super-rough estimate says the feds could do a hostile takeover of the US health insurance industry for less than $3 trillion. That's the carrot -- the fair market value of corporate shares held by mostly-rich investors, or equivalent. The stick: eminent domain. So it's a forced sale, but at a fair price.

Where does the $3T financing come from? One possible idea: bonds issued by a federal Health Infrastructure Bank. Much of the money to retire these bonds will come from already-existing cash flow in the current system. More than a half trillion dollars a year will come from net cost savings across public and private parts of the current system.

The Congressional Budget Office found that a public single-payer system could save our nation $650 billion a year or more, much of it stemming from administrative cost savings. Tens of billions would come from shutting down the vast scam of Medicare Advantage, which lets insurers keep up to 40% of the money they collect from Uncle Sam. By contrast, traditional Medicare admin costs 2% or less. Additionally, physicians in private-practice groups need two billing clerks for every three doctors, a staggering cost, completely unnecessary under a single-payer system. Similarly, US companies spend billions managing healthcare insurance for employees. All that would go away too.

I could go on, but suffice to say, our entire broken system is hemorrhaging cash via such eye-popping inefficiencies while doing nothing to help heal a single patient.

By switching to single-payer and applying related reforms and efficiencies (such as "global budgeting" for hospitals), the proposed Health Infrastructure bonds could be paid off in as little as five or ten years. That's while fully covering all necessary medical costs for every man, woman and child in America, forever. Here's a partial view of positive impacts: https://medium.com/@idember/pigs-fly-cbo-admits-medicare-for-all-will-aid-people-businesses-economy-e32d72ce59a2.

Private insurers could still sell plans to cover optional care, such as cosmetic surgery, cosmetic dental work, and fancy eyeglasses that many people prefer. And pet insurance, a fast-growing field. But for the rest of us, single-payer would be a godsend and, in the long run, lots cheaper than our current system. How's that for an investment?

Why don't we have this commonsense solution already? Because a corrupt Congress is stalling the legislation — HR 3421 and its counterpart, S.1655. (Among well over a hundred co-signers so far, not one is a Republican.) Is your representative and senators on board? If not, why not? Demand it now!